What is Yield?

Feb 2025

This article explains crypto yield in simple terms, provides examples of its sources, and how to manage it effectively.

Overview

As you navigate DeFi, the term 'yield' often pops up. In the most basic terms, yield refers to the earnings generated and realized on an investment over a particular period. These earnings can come from various activities such as:

- Lending: Platforms like Aave, Compound, and Morpho.

- Staking: Services such as Lido and EigenLayer.

- Yield Farming: Platforms like Yearn, Harvest, and Beefy.

Understanding Interest-Bearing Tokens

When you put your tokens to work on one of these platforms, you receive proof of deposit as an Interest-Bearing Token. For example, when you lend USDC to Aave, you receive aUSDC in return. This aUSDC represents your lent USDC and entitles you to the interest it accrues over time.

Detailed Examples of Yield-Generating Activities

Lending

Lending protocols like Aave, Compound, and Morpho allow users to lend their crypto assets to earn yield. For example, when you lend USDC to Aave, you receive aUSDC in return. This aUSDC represents your lent USDC plus the interest it accrues over time.

Staking

Staking involves locking up tokens to support a platform's operation or liquidity in exchange for rewards. For instance, you can stake ETH via Lido Finance to earn rewards for securing Ethereum, receiving stETH as yield.

Yield Farming

Yield farming involves navigating the DeFi landscape to maximize yield by leveraging multiple protocols. For example, you can put ETH into a yield farming protocol like Yearn Finance, which rebalances it across various lending protocols to get the best APY.

Dealing with APY Volatility

APY (Annual Percentage Yield) represents the yearly rate of return you can expect from yield-generating activities. However, APY isn't fixed and can fluctuate due to factors like:

- Supply and demand dynamics

- Changes in liquidity

- Protocol governance decisions

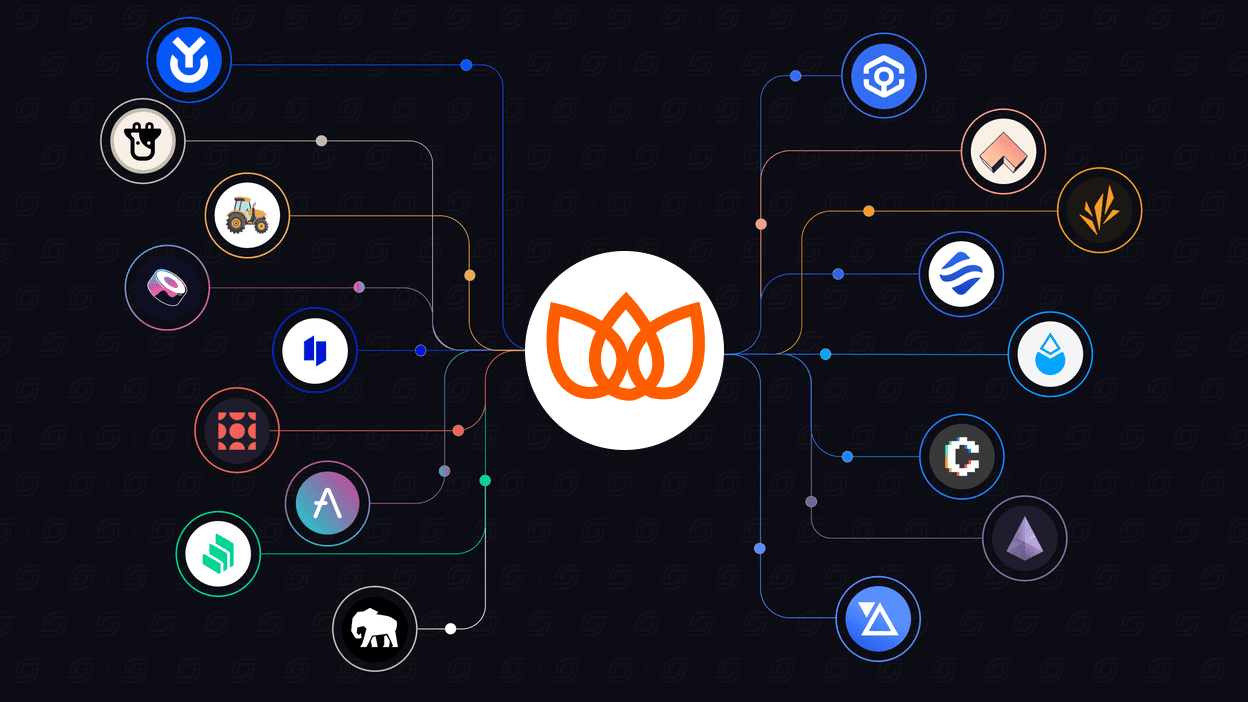

How Necta Helps

Necta's intelligent agents continuously monitor and analyze APY across different protocols, automatically reallocating your funds to optimize returns while maintaining your risk preferences.

Looking Ahead

Understanding yield in DeFi is crucial for making informed investment decisions. With Necta's automated approach, you can navigate the complexities of yield optimization while maintaining full control of your assets.